Guide to Smarter Property Investing: Lessons from Joseph’s Story

As a first-time real estate investor, you’ll likely find out the hard way that:

Not every affordable apartment makes a smart investment.

Joseph, a 34-year-old Nairobi IT professional with a decent job in tech, some savings,

and a firm belief that real estate was his ticket to financial independence,

felt it was time to make his move.

His parents had always told him, “Real estate is the only investment that does not disappoint.”

Lately, banter with his colleagues had only added fuel to the fire.

As they shared their experiences at weekend open houses, his appetite to dive in grew.

They often claimed to have found off-plan gems known only to a select few,

which only made his anticipation even more intense.

But deep down,

Joseph wasn’t chasing the thrill of owning a property – he had a bigger vision in mind.

He wasn’t interested in flipping for quick gains or buying a showpiece for bragging rights like his buddies.

He was hunting for one thing: an evergreen asset that would put money into his pocket every month.

He wanted an apartment that:

- Would cover its own costs and expenses.

- Wouldn’t be a constant headache with repairs.

- Would have tenants lining up to rent.

In short, he was looking for a rock-solid, income-generating property.

The kind that lives up to Robert Kiyosaki’s definition of an asset:

“something that puts money in your pocket.”

Joseph knew that if he got it wrong, he’d be stuck with an investment that drains his savings instead of growing them.

But in Nairobi’s housing market, that’s easier said than done.

The Mirage of Affordability

Affordable housing is having its moment.

Billboards flash promises.

Government programs highlight thousands of units delivered.

Developers tout “budget luxury” as the next big thing.

Problems begin when you run the numbers – the math doesn’t add up.

The government’s subsidized housing plan is noble in purpose — helping thousands access decent shelter.

But for the investor who is looking to buy a unit, rent it out and earn at least 10% annual returns?

The government housing isn’t for you.

Most of these houses fall short on things that matter to Nairobi’s growing middle-income renters. Whether it’s location, size, finishing quality, or long-term livability.

Miss this, and you won’t find tenants willing or able to pay the rent your investment needs.

“If I put in 3 million and can only charge Ksh 15,000 a month, I’m barely above 5% yield,” Joseph says.

“After service charges, tax, and maintenance, I’d be lucky to break even.”

He had a point.

The free market isn’t sentimental.

Rental income is driven by tenant demand – real, paying tenants.

Tenants who pay Kshs. 40,000 or more each month won’t settle for such properties. They are turned off by dull, uninviting facades, cramped spaces, or inaccessibility due to poor infrastructure.

It’s a common mistake many make.

On the surface, everything looks perfect – until you realize you’ve walked full-on into a trap:

- The mouth-watering price tags.

- The picture-perfect renders.

- The flexible payment plans.

But the real test comes later:

- When the unit sits empty.

- When tenants cycle in and out every few months.

When your returns disappear into repair bills and complaints.

Behind the Curtain: What the Savvy Investors Know

When Joseph first approached Njeri, he had two key advantages:

He was cautious, and humble enough to ask for help.

He didn’t rush into the hottest new development. He didn’t chase online hype. Instead, he spent weeks mapping out his goals:

- What monthly rental income did he need?

- How much downtime could he afford between tenants?

- What areas had consistent demand and low tenant turnover?

- What finishing standards would ensure reduced maintenance costs?

They reviewed more than 30 listings, visited 8 developments, and ran various financial simulations.

They filtered each opportunity by yield, location, tenant profile, and build quality.

Only two passed the test.

“It’s not that there aren’t good investments,” Njeri explains.

“It’s that you need to know how to spot them, because:

- They rarely look flashy.

- They rarely come with loud marketing.

- They’re often owned by people who never sell.”

To easily identify those rare winners from the rest,

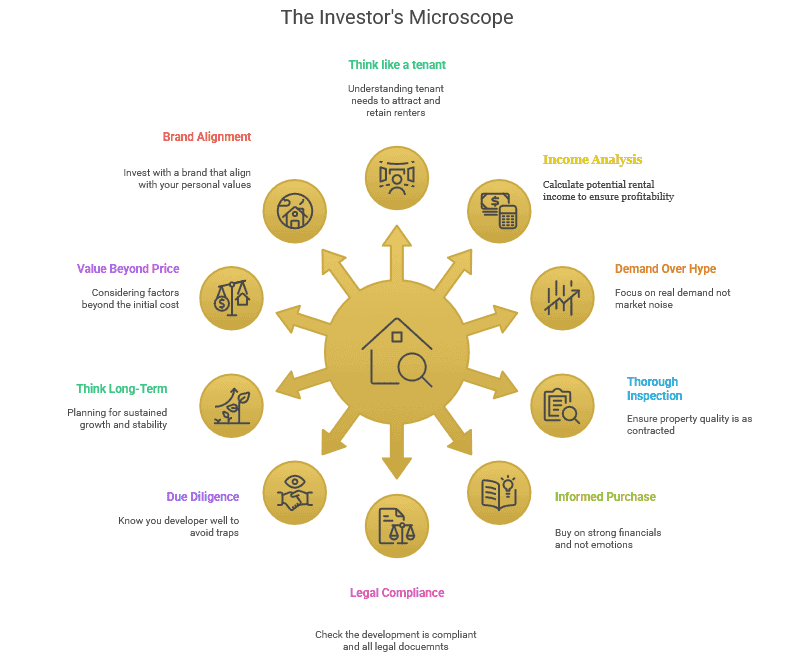

Njeri relies on a proven 10-point framework she calls ‘The Investor’s Microscope’.

A method designed to separate solid, income-generating homes from empty promises.

Here’s a quick look at two of the most critical filters she uses to spot high-performing properties:

✅ 1. Think Like a Tenant

You’re not the customer — your tenant is.

Successful investing starts with empathy. If your ideal tenant wouldn’t live there, neither should you invest there.

Ask yourself:

- Is the environment peaceful, clean, secure and easily accessible?

- Does the property have natural light, good airflow, and a functional layout?

- Is there consistent water supply, Wi-Fi access?

A desirable unit attracts stable, long-term renters — and they’re the backbone of reliable income.

✅ 2. Do the Income Math First

Real estate is a numbers game. Don’t guess — calculate.

If the math doesn’t work on paper, it won’t work in real life.

- Rental Yield = (Annual Rent ÷ Buying Price) × 100

- Target Nairobi’s mid-income rentals at between 9–12%.

- After accounting for all costs (service charge, vacancy, tax, insurance ), does it still put money in your pocket each month?

If the math fails, don’t rationalize it — walk away.

Want the full checklist?

Coming soon!

You’ll be able to Download the full 10-point Investor’s Microscope + Property Scorecard and use it to evaluate your next deal with confidence.

The BIG Mistake

If the process is this clear, why do most people still get it wrong?

Njeri says it’s because people confuse owning property with investing in property.

One gives you status. The other gives you income.

And in the age of Instagram real estate agents and sleek, picturesque renders, it’s easy to be sold on a dream.

“Some people get excited by the brochures that say 12% returns,” she says.

“But they never ask:

- Based on what?

- Who is the target tenant?

- Has this rent ever been achieved in this area?”

Joseph, to his credit, stayed grounded.

When his friends bought apartments off-plan in the city outskirts, he waited.

One time, in Kilimani, an opportunity came up that looked promising. But after a closer look, it had poor ventilation and a high service charge.

He knew better – and let it go

It’s Not an Asset, until it Pays You

To answer Joseph’s question: what makes an apartment a true income-generating asset?

“It’s all about the numbers,” says Njeri, a private real estate consultant.

She specializes in guiding first-time investors through what she calls “the yield maze.”

She doesn’t just sell homes. She guides you through a framework that you can easily follow by yourself.

“You start with one simple question,” she says.

“If this unit was a machine, would it produce more cash than it consumes?”

“More often than not,” she adds.

“Buyers don’t ask themselves this question.”

They buy emotionally, not financially.

They fall for glossy surface finishes. Sleek kitchens. The dream of ownership. Even when the numbers don’t add up.

Remember, the market doesn’t forgive such ignorance.

“I’ve had clients come to me after they bought, saying:”

- The promised rental yields didn’t materialize. They were too futuristic

- Too many repairs gobbling the little rental incomes.

- Or the access roads become impassable whenever it rains.”

The solution, Njeri says, isn’t just finding a “good deal,”

It’s understanding what makes a deal good in the first place.

Later, he found an off-plan, one-bedroom flat in a quiet, well-connected part of Nairobi West – over 500 sqft, with an exquisite show house, and priced below market.

Within two weeks, he had paid the deposit and began the ownership journey.

Similar units nearby rent for Ksh 40,000/month – putting his projected return at 11% annually.

The Rewards of Disciplined Investing

For Joseph, the payoff is more than just the money –

it’s the peace of mind.

The feeling that his asset is continuously earning, even when he won’t be able to.

It’s the opposite of what many Nairobi investors experience:

Constant repairs, endless tenant complaints, unexpected charges, or months of vacancy.

Joseph’s journey didn’t just earn him a rental cheque;

it earned him confidence, clarity, and freedom.

Today, he’s already saving toward securing a second apartment unit.

Same approach. Same math. Same discipline.

Would you like to see what that could look like for you?

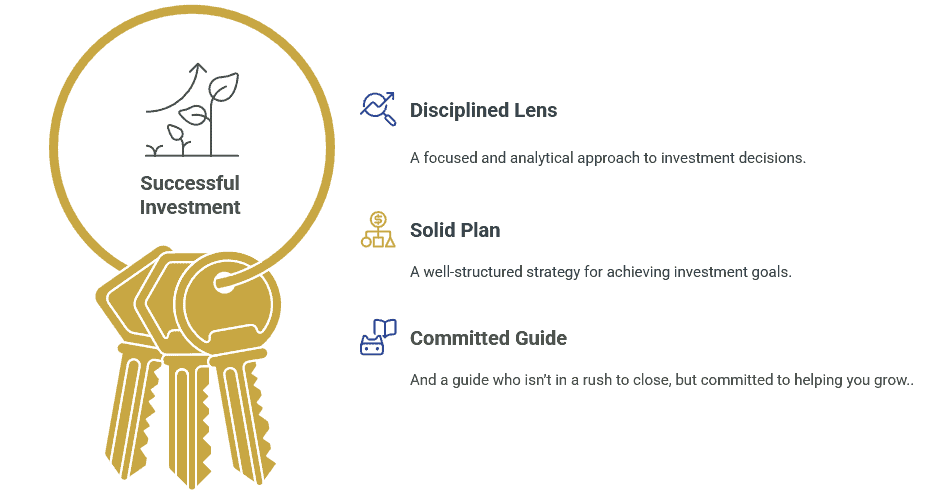

Your First Investment will make or break you

In real estate, your first deal teaches you more than any book ever could.

It either builds your confidence or shakes it;

either it becomes the start of your portfolio, or the reason you stop at one.

With the difference coming down to:

Affordable housing may be everywhere in Nairobi.

But affordable investing? No, not so – that’s a different story altogether.

The cost is often the same, but the outcome depends on:

- How you choose,

- Who advises you, and

- Whether you’re led by numbers or by emotion.

Going by Robert Kiyosaki’s definition:

An asset is something that puts money in your pocket, and

A liability is something that takes it out.

A rental property qualifies as an asset only if its rental income exceeds its expenses (mortgage, taxes, repairs).

“So, ask yourself:

“Am I buying a liability disguised as an asset?

Or, am I investing in a machine that will keep churning out returns for years to come?”